1980s

- June 1985 – Dan Gilbert founded Rock Financial, which would become known as Rocket Mortgage, in 1985. The company was initially founded as a mortgage broker.

- 1988 – Rock Financial took the steps to become a mortgage lender. Rocket Mortgage is now the largest retail mortgage lender in America.

1993

- The company achieved $1 billion in annual closed loan volume for the first time.

Rocket Mortgage now has more than $1.75 trillion of mortgage volume in total.

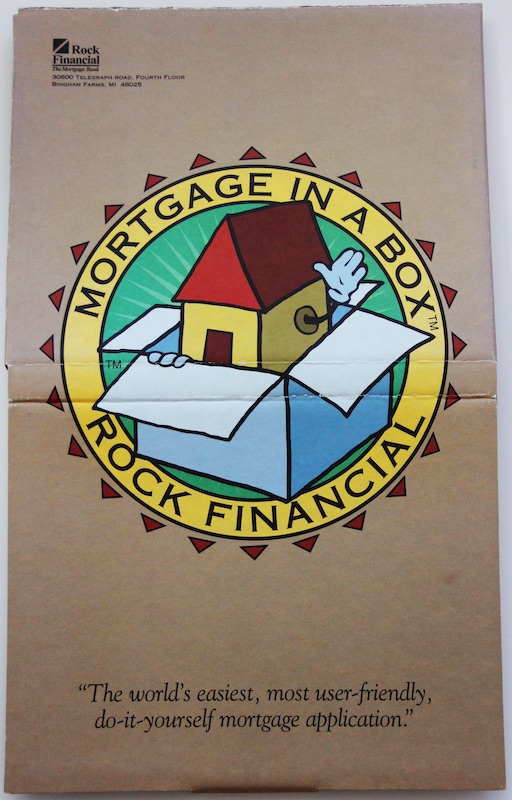

1996

- Mortgage in a Box, the precursor to today’s centralized online lending model, was released. This revolutionary mortgage application explained the process in an easy-to-understand way and after completing the form, clients would mail them back to Rock Financial – the same way that clicking the submit button on Rocket Mortgage sends the application to be reviewed today.

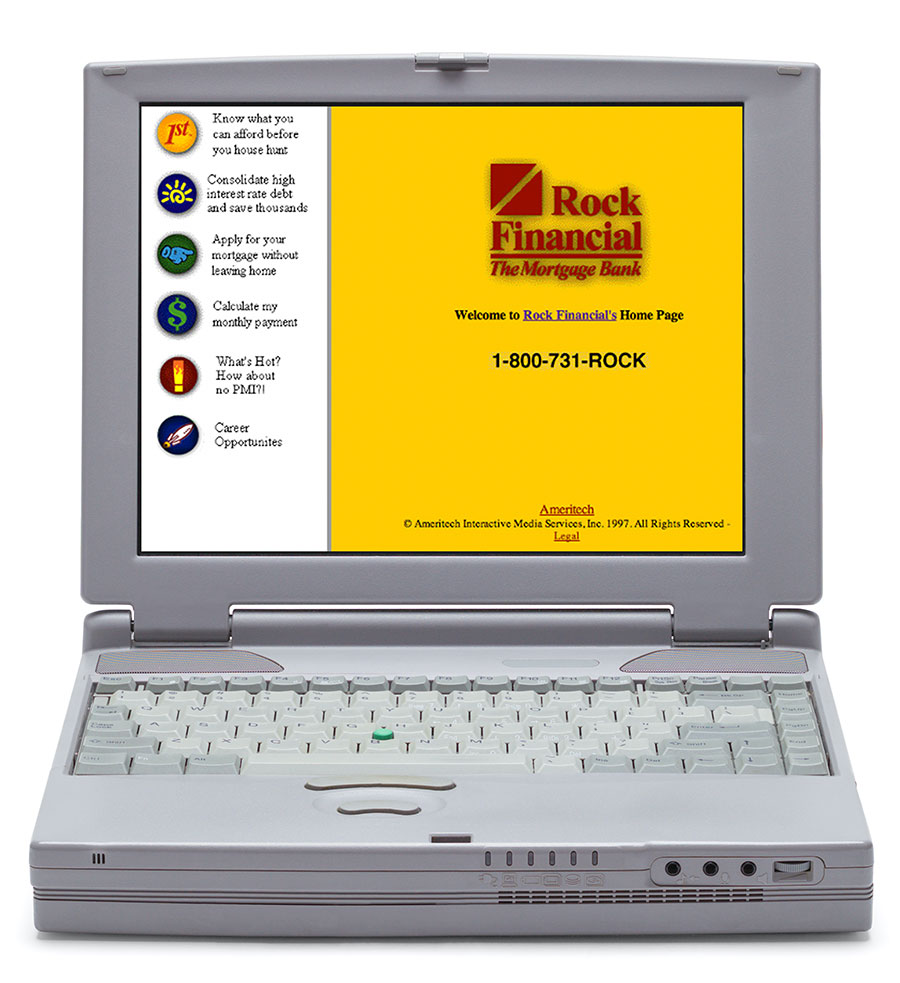

March 1998

- Dan Gilbert wrote an email to the company committing all its resources to moving the mortgage process online. His vision was decades ahead of its time. Most of the internet companies of that era focused on problems like search, advertising or basic e-commerce. Dan saw things differently.

May 1998

- Dan Gilbert took Rock Financial public, launching a successful IPO on the Nasdaq market under the symbol “RCCK.”

January 1999

- As the branch-based lender’s first step online, the company launched RockLoans.com. This quickly positioned it as one of the fastest growing online retail mortgage lenders on the internet.

December 1999

- Seeing the possibilities of this mortgage lender rooted in technology, Intuit Inc. (creators of market-leading software TurboTax and QuickBooks) purchased Rock Financial. The company was renamed Quicken Loans.

January 2002

- The company provided clients the ability to review and electronically sign documents for the first time – marking the next major step in the company’s tech heritage.

August 2002

- Placed on Fortune’s prestigious “100 Best Companies to Work For” list for the first time. As of December 2023, the company has ranked in the top one-third of the list for 21 consecutive years.

December 2003

- Dan Gilbert led a small group of private investors in purchasing Quicken Loans Inc. back from Intuit. The company retained all Quicken Loans branding and marketing initiatives.

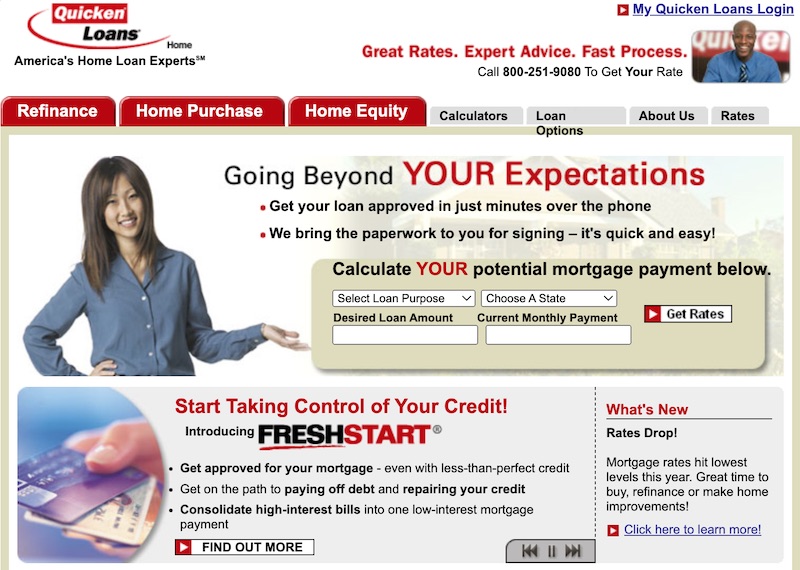

August 2004

- What would later become the preeminent mortgage website, the company launched QuickenLoans.com for the first time. The newly redesigned site gave consumers more tools and greater functionality to explore their home loan options, calculate payments and apply for a mortgage online.

2008 & 2009

- The company was able to grow its market share significantly during the turmoil in the mortgage industry, due in large part to the company’s refusal to originate sub-prime mortgages in the time leading up ‘The Great Recession.’

May 2010

- Rocket Pro, founded as Quicken Loans Mortgage Services (QLMS) — now known as Rocket Pro — was created to serve the needs of mortgage brokers, community banks and credit unions. It is currently one of the largest lending partners to mortgage brokers, providing them technology to best serve their clients and the resources to grow their businesses.

August 2010

- Quicken Loans moved its headquarters to downtown Detroit, kicking off more than a decade of investment in the city. Rocket Companies is now one of the largest employers in the city of Detroit.

November 2010

- Quicken Loans received its first J.D. Power award for client satisfaction in mortgage origination. In total, the company has received won 12 J.D. Power awards for client service in mortgage origination.

- That same month, the company closed its one millionth loan. Rocket Mortgage has originated more than 7 million mortgages in total.

June 2011

- Quicken Loans launched “My QL Mobile,” the first mobile app from a mortgage lender. The app provided real-time loan status updates, an interactive list of all the documents needed for the mortgage process and access to a home loan expert at the tap of a button. Currently, more than half of client use Rocket Mortgage on a mobile device. The Rocket Mortgage app has a rating of 4.9 out of 5 stars on the iOS app store.

End of 2012

- The company significantly entered the mortgage servicing business, announcing it had built an $80 billion servicing portfolio as of the end of 2012. Rocket Mortgage now has a servicing portfolio of 2.6 million clients and more than $500 billion.

March 2014

- The company drew international attention for its Billion Dollar Bracket challenge, in partnership with Berkshire Hathaway and Yahoo Sports. The promotion offered a $1 billion grand prize for a perfect men’s college basketball bracket, along with $2 million in prizes for 20 most accurate brackets and $1 million for funding of inner-city educational efforts.

July 2014

- J.D. Power ranked the company highest in customer satisfaction among home loan servicers for the first time in the first year it was eligible. In total, the company has received 10 J.D. Power awards for client service in mortgage servicing.

August 2015

- The company partnered with the Detroit Land Bank on “Rehabbed and Ready” public-private campaign to renovate homes, increase occupancy and bring pricing stability to Detroit’s neighborhoods. To date, nearly 100 homes have been renovated through the program. This program has helped stabilize property values in disadvantaged neighborhoods, allowing residents to access the equity in their home as well as setting new comps that allow prospective homebuyers to obtain mortgages.

November 2015

- Quicken Loans introduced Rocket Mortgage, the first end-to-end completely online mortgage experience. Rocket Mortgage users can go from application to approval and lock their rate online, without having to talk to a banker.

2016

- Rocket Loans – a technology-driven personal loan platform that is part of Rocket Companies – first launched in 2016

February 2016

- The company debuted its first Super Bowl commercial, which introduced Rocket Mortgage to the world. As of February 2025, The company has advertised in six Super Bowls. In 2025, Rocket unveiled its new brand identity and launched its “Own the Dream” core creative idea during the game.

October 2017

- Quicken Loans partnered with the United Community Housing Coalition (UCHC) and eight community development organizations to launch an extensive education effort addressing the pervasive issue of tax foreclosure in Detroit. This door-to-door outreach attempted to reach all 60,000 residential properties behind on property taxes and connect residents at risk of tax foreclosure to resources.

Q4 2017

- The company became the nation’s largest mortgage lender in the 4th quarter of 2017.

May 2018

- Rocket Homes acquired ForSaleByOwner.com. Founded in 1999, the site is America’s leading online marketplace exclusively focused on helping consumers who want to sell their own home.

October 2018

- Quicken Loans and the Rock Family of Companies announced a new technology office in Windsor, Ontario. Today, the office – called Rocket Innovation Studio – enables Rocket Companies to recruit top talent from Windsor, Toronto, Waterloo and across Ontario to support the growing need for additional technology talent.

June 2019

- Rocket Mortgage hosted the inaugural Rocket Classic, the first-ever PGA Tour event held in Detroit and the most awarded PGA TOUR event of the season. In 2020, the tournament introduced the Changing the Course initiative to bridge the digital divide in the city and bring access to the internet and devices to all Detroiters. In the fall of 2021 the Rocket Classic was extended through 2027.

October 2019

- Rocket Mortgage became the first lender to develop the capabilities to perform electronic mortgage closings (eClosings) in all 50 states.

August 2020

- Rocket Companies, parent to Rocket Mortgage and other FinTech brands, celebrated its debut on the New York Stock Exchange as a publicly traded entity. Rocket Companies stock began trading under the ticker symbol RKT.

March 2021

- Gilbert Family Foundation and Rocket Community Fund – the philanthropic partner to Rocket Companies – announced an unprecedented and transformational $500 million investment to build economic opportunity in Detroit neighborhoods over the next 10 years.

July 2021

- Quicken Loans officially changed its name to Rocket Mortgage as a nod to what the company does best – take a complicated process and make it simpler and faster using technology.

September 2021

- Rocket completed its millionth eClosing, demonstrating its leadership in the space.

December 2021

- Rocket Companies acquired Truebill (now known as Rocket Money) adding rapidly expanding financial empowerment FinTech to the Rocket Platform.

July 2022

- Truebill changed to Rocket Money – bringing the company closer to the other businesses on the Rocket Companies platform and provide the opportunity for Rocket Money to better help consumers at various touchpoints throughout their financial lives.

September 2022

- Amrock introduced proprietary technology to electronically close (eClose) mortgage transactions entirely from a mobile device. This new product represented the final step in Rocket Companies’ creation of a seamless, end-to-end real estate experience clients can use to go from application to closing on the iPhone or Android phone they use every day.

March 2023

- Rocket Companies introduced the Rocket Visa Signature Card, the first credit card created to make homebuying easier and more accessible. Homebuyers can earn 5% back on their everyday spending to use toward closing costs and down payments Homeowners with loans serviced by Rocket Mortgage can choose to use their points to receive 2% of their card spending toward their unpaid principal balance. The Rocket Visa Signature Card is integrated with Rocket Money.

May 2023

- Rocket Mortgage launched ONE+, a 1% down program that only requires homebuyers to make a down payment of 1% and Rocket Mortgage will cover the remaining 2% — addressing homeownership accessibility for more than 90 million Americans. ONE+ also eliminates expensive mortgage insurances fees for the homebuyer, saving them thousands of dollars a year. ONE+ is the newest addition to Rocket Mortgage’s affordable options that aim to make homeownership achievable.

June 2023

- Rocket Family of Companies reached 1 million hours volunteering with community organizations and nonprofits. This achievement is a testament to Rocket’s deep-rooted commitment to making a meaningful impact in the communities they serve. Nearly 36,000 team members dedicated their time and energy to over 150,000 events, embodying the company’s spirit of service and generosity. Notably, Detroit-based team members contributed more than 70% of those hours, showcasing their unwavering dedication to directly improving the lives of others.

April 2024

- Rocket Companies introduces Rocket Logic, a platform powered by Artificial Intelligence (AI) designed to close loans faster and make homeownership simpler.

Rocket Logic is part of the technological ecosystem that Rocket is building to fuel every process of the homeownership experience with AI, supercharging team members with accuracy, speed and confidence to streamline data and information processing.

January 2025

- The all-in-one home search, financing and servicing platform, Rocket.com was launched. This revolutionary platform streamlined the home search experience for clients. At the site’s heart is Rocket’s AI Agent, providing 24/7 support and keeping real-estate agents and clients alike informed at every step of the way. By integrating the deep property insights of Rocket Homes with the award winning service provided by Rocket Mortgage, finding and buying is made even easier.